Some Ideas on Clark Wealth Partners You Should Know

Wiki Article

Some Known Questions About Clark Wealth Partners.

Table of ContentsWhat Does Clark Wealth Partners Do?How Clark Wealth Partners can Save You Time, Stress, and Money.How Clark Wealth Partners can Save You Time, Stress, and Money.Some Known Questions About Clark Wealth Partners.The smart Trick of Clark Wealth Partners That Nobody is DiscussingNot known Facts About Clark Wealth PartnersFacts About Clark Wealth Partners RevealedClark Wealth Partners Fundamentals Explained

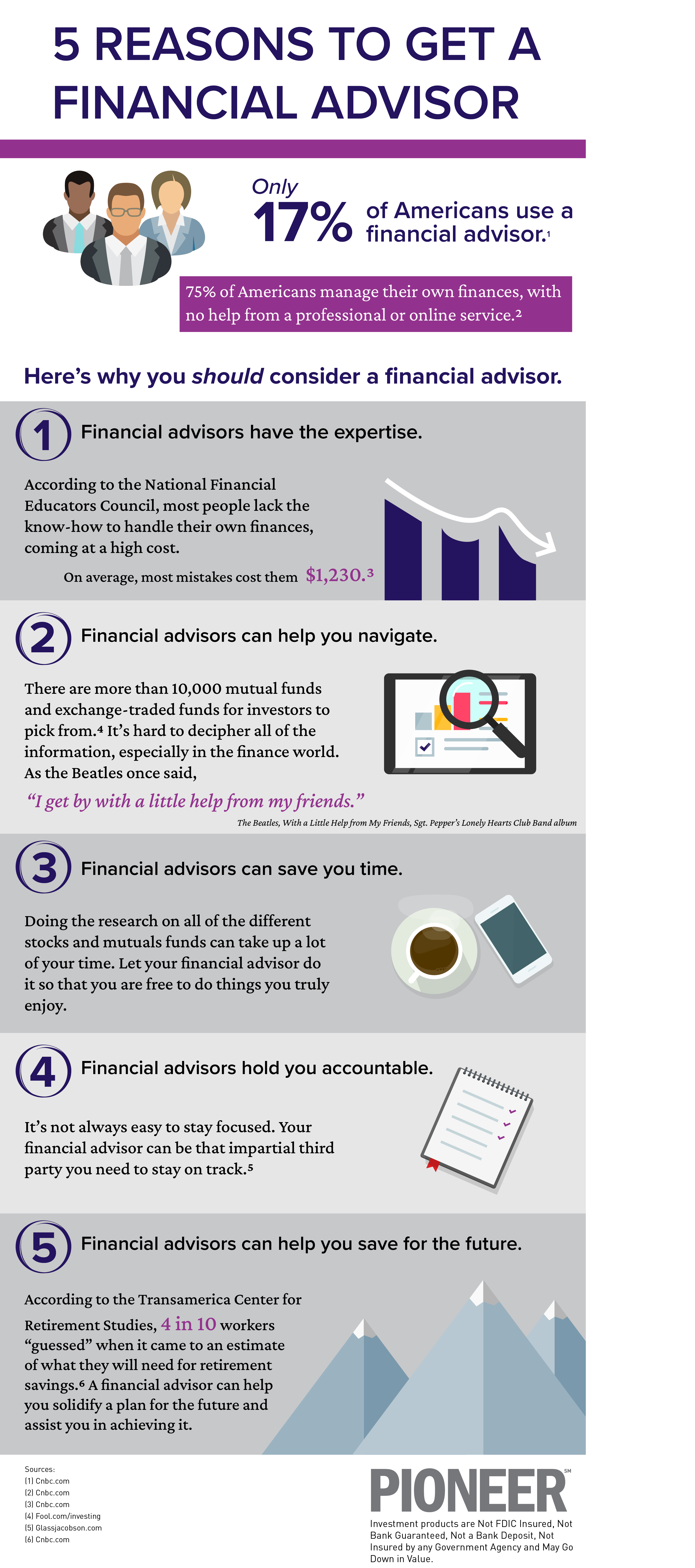

Common factors to consider a monetary consultant are: If your monetary situation has actually become extra complex, or you lack self-confidence in your money-managing skills. Saving or browsing significant life occasions like marital relationship, separation, youngsters, inheritance, or task adjustment that may dramatically affect your economic circumstance. Navigating the change from conserving for retirement to maintaining wealth during retired life and how to develop a strong retired life income strategy.New innovation has actually led to even more extensive automated financial tools, like robo-advisors. It depends on you to check out and determine the best fit - https://www.pageorama.com/?p=clrkwlthprtnr. Inevitably, a good economic consultant ought to be as conscious of your investments as they are with their own, staying clear of too much charges, conserving cash on taxes, and being as clear as feasible about your gains and losses

The Of Clark Wealth Partners

Making a compensation on product suggestions doesn't always imply your fee-based expert antagonizes your ideal passions. They may be extra likely to recommend products and solutions on which they earn a compensation, which may or might not be in your ideal rate of interest. A fiduciary is lawfully bound to place their client's interests.This conventional permits them to make referrals for financial investments and services as long as they fit their client's objectives, threat tolerance, and economic situation. On the other hand, fiduciary consultants are lawfully bound to act in their customer's best interest instead than their own.

Little Known Questions About Clark Wealth Partners.

ExperienceTessa reported on all points investing deep-diving into complicated financial subjects, dropping light on lesser-known financial investment avenues, and discovering methods readers can work the system to their benefit. As a personal financing professional in her 20s, Tessa is acutely familiar with the influences time and unpredictability have on your investment choices.

It was a targeted ad, and it worked. Learn more Check out less.

Excitement About Clark Wealth Partners

There's no single path to ending up being one, with some people beginning in banking or insurance policy, while others begin in accountancy. A four-year level provides a strong structure for professions in financial investments, budgeting, and customer solutions.

The Buzz on Clark Wealth Partners

Common examples consist of the FINRA Series 7 and Collection 65 tests for safety and securities, or a state-issued insurance certificate for marketing life or medical insurance. While credentials might not be lawfully required for all intending duties, employers and clients frequently watch them as a standard of professionalism. We look at optional credentials in the following area.Most monetary organizers have 1-3 years of experience and experience with monetary items, compliance requirements, and direct client communication. A strong instructional background is essential, yet experience demonstrates the capacity to use concept in real-world settings. Some programs integrate both, allowing you to finish coursework while making monitored hours via internships and practicums.

Facts About Clark Wealth Partners Revealed

Many go into the field after operating in financial, bookkeeping, or insurance policy, and the transition calls for persistence, networking, and frequently sophisticated qualifications. Very early years can bring lengthy hours, stress to build a client base, and the demand to consistently verify your expertise. Still, the job offers solid long-lasting capacity. Financial organizers take pleasure in the opportunity to work very closely with customers, overview essential life choices, and typically achieve versatility in routines or self-employment.

Riches managers can raise their earnings via compensations, possession costs, and efficiency rewards. Financial supervisors look after a team of financial organizers and advisers, setting department approach, managing compliance, budgeting, and guiding internal procedures. They invested much less time on the client-facing side of the market. Almost all economic managers hold a bachelor's level, and numerous have an MBA or similar graduate level.

Not known Details About Clark Wealth Partners

Optional accreditations, such as the CFP, usually call for additional coursework and testing, which can prolong the timeline by a pair of years. According to the Bureau of Labor Stats, personal monetary experts make an average annual yearly wage of $102,140, with top earners earning over $239,000.In check this site out other districts, there are guidelines that need them to meet certain requirements to use the financial expert or financial organizer titles (financial company st louis). What sets some monetary advisors aside from others are education, training, experience and certifications. There are numerous classifications for financial consultants. For monetary planners, there are 3 usual classifications: Licensed, Individual and Registered Financial Organizer.

Some Known Details About Clark Wealth Partners

Those on income may have a reward to promote the items and services their employers supply. Where to discover a monetary consultant will certainly depend upon the sort of suggestions you require. These institutions have staff who may help you understand and get specific kinds of financial investments. Term deposits, guaranteed investment certificates (GICs) and common funds.Report this wiki page